Cash is – finally – offering a return

The lower-risk part of the market has been a challenging place to invest since 2008. With central banks taking rates down to zero or even negative territory, investors have struggled to find returns from lower risk products. This all changed in 2022.

In the last 18 months, the ECB has raised its central bank deposit rate 10 times, taking it from –0.5% up to 4.5%. Other central banks have followed the same pattern, and this has fed through into bond yields and banks’ offerings. W hile many mortgage borrowers are now under considerable pressure, either paying higher rates already or anticipating the end of their fixed rate with dread, investors with cash are finally able to find positive interest rates on their savings or holdings in treasury deposits, money market funds and government bonds.

Cash is king … or is it?

Many investors have moved into cash during this period, driven both by the turmoil seen in equity and bond markets and by the possibility of higher interest returns with very low risk. And cash has served them well.

As we move into 2024, though, is cash still the only place to be? We don’t think so.

Where now?

The step-change in rates over the last 18 months is a one-off. We have left the very low rates that followed the Financial Crisis and no-one expects central banks to return to such levels any time soon. Equally the prospect of rates going much higher in the short-term seem unlikely.

What is not clear, however is how long rates stay where they are, as inflation falls and economic growth slows, and when we can expect rates to start coming down. The challenge now is to position your assets where they can optimize returns through the various potential outcomes.

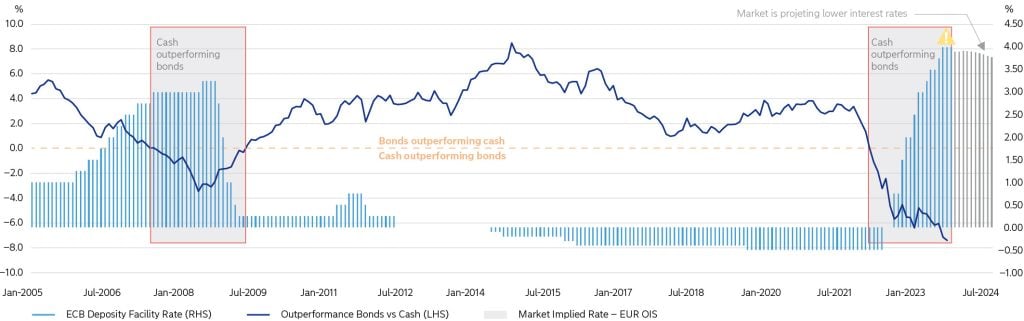

The chart below shows that the last time cash outperformed bonds was in 2007-9, and highlights that bond performance relative to cash began to improve right around the peak in interest rates. While we have to consider various economic scenarios, the market expectation is that lower rates are coming. The evidence shows that markets move very quickly. Investors who wait to move their cash once falling interest rates are starting to hurt them may find themselves buying bonds at considerably higher prices.

How long can cash outperform bonds?

Time to move

After recent central bank meetings, the message that has been communicated to the market is that we are reaching the peak of the hiking cycle. Investors need to start to reflect on how best to position their portfolios for next moves, even though the timing of potential rate cuts remains very much up in the air.

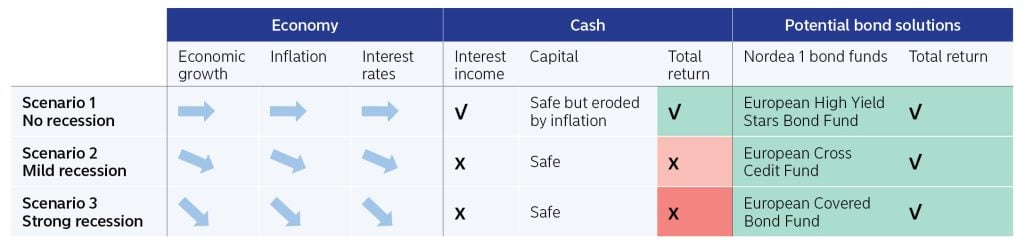

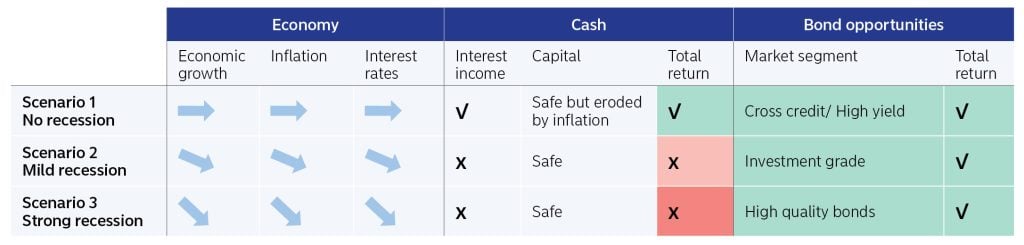

In this context there are three potential scenarios to consider:

The first scenario is where economic growth remains positive with inflation moderating and rates stay at around current levels. In this scenario, cash remains king, continuing to deliver attractive income. However, ongoing inflationary pressure will erode the purchasing power of cash. Here, lower risk bonds would most likely underperform cash as capital values may remain under pressure. Investors will need to move towards High Yield to achieve returns high enough to tempt them out of cash. In this no-recession scenario, High Yield remains attractive. Crossover solutions, which straddle the High Yield and Investment Grade segments, are another way to capture higher returns without committing so heavily to High Yield.

This scenario is the least likely of the three: even if the first rate cut is a year away, markets tend to anticipate so the cash-is-king situation is unlikely to remain in place for very much longer.

Scenario two is mild recession – economic growth and inflation come down and therefore central banks cut interest rates. In this scenario, falling interest rates will hit returns offered by cash deposits. On other hand, while bond yields will also fall, their value will go up and the capital gain will compensate for the loss of income. Therefore bonds will outperform cash. In a mild recession, the risks increase for the High Yield part of the market so a better risk-return balance is likely to come from Crossover solutions or, for slightly more conservative investors, Investment Grade bonds. Falling rates will drive performance at the longer end of the yield curve, so investors should focus on higher duration strategies.

Our third scenario is a more severe recession, with sharper falls in economic growth, inflation and also interest rates. Falling rates will hit both cash and bond holdings, but bond prices will go up as yields come down – especially longer-dated bonds – and this will offset the falling yields and drive bonds to outperform cash in this scenario too. In a full-blown recession, longer duration high quality bonds – Sovereign, Covered and the highest quality Corporates – are the most likely to deliver the returns investors are looking for.

Beyond cash

Everyone needs to hold some cash for their spending needs, but cash balances have built up over the last couple of years as investors have found few better alternatives. For some, this has been the result of inaction, while others have made active allocations into cash. Nevertheless, investors are most likely to achieve their long-term return goals with a broader asset allocation than cash alone, and therefore need to reassess their allocation periodically. Adding even a very modest amount of risk to a portfolio can result in modestly higher returns – which compound over time.

Locking cash up for a period such as 12 months is very tempting, with attractive rates currently available. Doing this, however, exposes investors to lower interest rates at the end of this period, by which time the most attractive entry point into other asset classes may have passed.

Now is the time, therefore, that cash-heavy investors should actively consider their positions. With the key market drivers stabilizing and now likely to change – with rates now expected to come down, whether in the near term or medium term – the relative attractiveness of cash vs bonds is also likely to change.

What are my bond options?

History highlights that bonds tend to outperform cash after interest rates peak, and we have discussed above why this could be the case again this time. However, bonds is a big category, with a very wide spread of risk and return options.

The lowest risk investors can invest in bond assets with a short duration (and therefore with little interest-rate sensitivity) and low credit risk (little risk of default), while those looking to enhance their returns and willing to take on higher risk can dial up both interest-rate exposure and credit risk. Investors with more specific views about market drivers can find investment solutions that focus their risk more on one or the other of these return drivers.

The most important thing to bear in mind with a move into bonds is diversification. Whether you are dipping a toe into lower-risk bonds or moving aggressively into higher yielding assets, a managed portfolio offers the best chance of optimizing risk-adjusted returns through portfolio diversification and of adding outperformance.

Nordea Asset Management offers a number of bond solutions ranging from very low risk, which can appeal to clients whose primary alternative would be cash, through to higher risk/ higher potential return bond funds that are well positioned to benefit more substantially from the market movements that may come with the peak in rates.

In the table below we highlight several of our funds that could be attractive to clients who are ready to move into bonds to enhance their returns.