GEOFFREY DYBAS, CFA

Manager of Nordea’s Global Real Estate Strategy Head of Real Estate & Senior Portfolio Manager Duff & Phelps Investment Management Co.

Key Highlights:

- With the rate reduction cycle starting to unfold, global listed real estate has recently morphed into a winner

- Despite the strong Q3 2024 performance, global REITs are still poised to outperform and deliver attractive returns in the long-term1

- Investors should consider allocating into active and public listed real estate strategies as they are more exposed to high growing property sectors and high conviction ideas

Q: Global listed real estate has faced some challenges over the past couple of years. Are headwinds becoming tailwinds?

A: Over the past 18 months, investors have been concerned about allocating capital into listed real estate given the rapid rise in interest rates and, more recently, due to the perceived “higher for longer” rate environment. However, we have been arguing for the past months that interest rates are coming down and that global listed real estate have shown the ability to outperform following the end of a rising interest rate cycle.

The third quarter could be the first real glimpse into a return to normal for REIT relative performance. During Q3 2024, waning inflation and compressing real rates favored listed global real estate. Additionally, we saw a notable shift in leadership from growth stocks to value-oriented and capital-intensive sectors and listed global real estate. This is a sharp contrast to the prior 12 months, when REITs significantly underperformed the broader market.

We believe that the asset class is experiencing a favorable regime shift and that global listed real estate is poised to outperform as the Fed already began to cut rates and more investors are broadening their exposure from a narrow list of tech names.

Q: Global listed real estate was up 16% in Q3 2024. Is now too late for clients to invest into Global REITS?

A: We do not think now is too late to invest in global REITs. While we recognize that returns for global REITs have been very robust quarter-to-date and over the last 12 months, we feel the performance is more a reflection of changing sentiment and making up for recent underperformance.

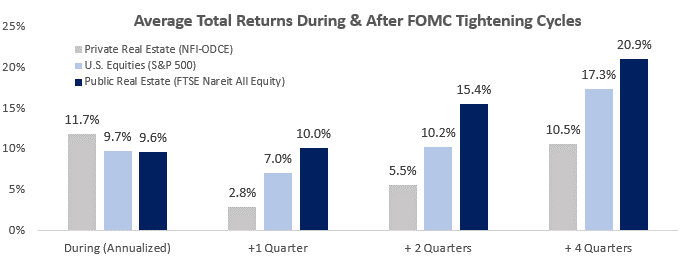

Looking at the global listed real estate performance since January 2022, the asset class has not completely recovered yet – being down close to -9% as of September 2024. If we take a longer term perspective, on a trailing 5-year basis, returns also remain well below their historical long run averages and have significantly trailed broader global equities, which leaves still room for REITs to deliver attractive returns in the long-term. Historically, REITs have returned 20.9% in the 12 months after a Fed tightening cycle, outperforming both private real estate (10.5%) and equities (17.3%).

On the other hand, we also expect cash flow growth to accelerate in 2025 from 2024, leading to higher dividend growth, which is well supported by healthy balance sheets. In addition, the preponderance of significant idle capital in the private real estate funds may lead to further M&A. Naturally, we could see some consolidation at current trading levels for Global REITs following the recent move, yet we find ourselves in what we view as the early days of easing central bank policy, a historical tailwind to Global REITs.

Chart Sources: Federal Reserve Board; Nareit; NCREIF; FactSet. Data as of 2023:Q4. Note: There have been 5 monetary tightening cycles since 1990. Analysis includes the first 4 cycles. The latest cycle was excluded due to the lack of data on 4 quarter results. The performance represented is historical; past performance is not a reliable indicator of future results and investors may not recover the full amount invested. The value of your investment can go up and down, and you could lose some or all of your invested money.

Q: Is global listed real estate trading at attractive valuations? How is it valued relative to global equities?

Q: How can a Global REIT exposure fit into an investor’s portfolio?

A: Global REIT exposure adds a good element of diversification to both a portfolio’s source of income and capital appreciation; hence, we think the sector fits well against both stocks and bonds. Historically, the sector has traded with a lower correlation to both stocks and bonds, adding to diversification versus both sectors.

Moreover, the dividend income which is often greater than the broad equity market dividend has accounted for roughly 50% of the total returns achieved by REITs. This is achievable given the strong focus of cashflow generation through rental activity. By investing in REITs, investors can enjoy financial exposure to global real estate across several property sectors with specialized management teams which helps add to the overall return of a portfolio.

Sources: Bloomberg and Duff & Phelps. Data in USD. Global market data: Stocks represented by MSCI ACWI Index, bonds represented by Global Bloomberg Aggregate Bond Index and Global REITs represented by FTSE E/N Developed Real Estate. Index returns are calculated on a total return basis with net dividends reinvested. Period ending as of June 2024. Past performance is not indicative of future results.

Q: Why should investors consider a public real estate allocation rather than private real estate?

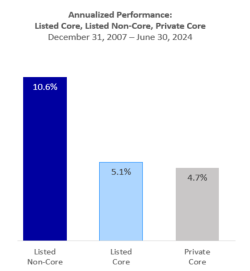

A: There are several benefits to investing in listed real estate versus private real estate. Given the recent rate cuts, we believe investors should consider allocation capital into public REITs as 12 months after a tightening cycle, listed real estate has historically outperformed private real estate by 10.4%. Even more recently, global listed REITs have outperformed private real estate since the Fed paused rate hikes in July 2023 (7.8% versus -9.3%, respectively)4.

Another key reason to invest in public real estate is for the access to next generation property sectors.

Traditionally dominated by core sectors such as retail, office, apartments, and industrial, the market has witnessed a transformation with the emergence of non-core sectors. These non-core sectors have diversified the real estate investment landscape and encompass a variety of property types like data centers, healthcare facilities, life science, self-storage, student housing, single-family home rentals, manufactured home communities, cell towers, gaming REITs, and alternative real estate assets.

Listed companies have regularly driven this expansion into newer property sectors and have gone on to build expertise in those sectors. Today, listed offers the opportunity for a more balanced portfolio with wider exposure to higher-growing (non-core) property sectors, as well as providing a hedge against economic downturns, as they are often less sensitive to economic cycles compared to traditional sectors.

Non-core property sectors comprise over 53% of the listed real estate universe versus 7% of the private real estate universe. Therefore, relying solely only on private may cause investors to miss the opportunities these sectors offer.

Chart Source: Duff & Phelps Investment Management Co. REIT universe represented by the FTSE Nareit All Equity REITs Index. This Index differs from the Duff & Phelps U.S. REIT strategy benchmark, the FTSE Nareit Equity REITs Index, in that it contains two additional non-core sectors, timberland REITs and telecommunication REITs. The listed core and listed non-core sector data above was carved out of the FTSE Nareit All Equity REITs Index. Private core represented by the NFI-ODCE Property Index. Duff & Phelps Investment Management Co. does not have data for private non-core performance. Indices are not available for direct investment and indices do not contain any fees. Different periods or points in in time may produce different results. Past performance is not indicative of future results.

Lastly, publicly traded REITs can be bought and sold on stock exchanges, providing greater liquidity compared to private real estate investments – which usually are not immediate and are subject to lockup periods.

Q: Passive investing has grown significantly over the past years. Why do you believe real estate investors should consider active strategies instead?

Firstly, more than three-quarters (88%) of the companies in FTSE EPRA/Nareit Developed Index are small- and mid-sized names. These names make up about 50% of the index’s weight. Traditionally, passive index funds are market-cap based, buying stocks whose market caps have grown the most. This typically results in passive strategies comprised of large-cap companies, which provides the opportunity for active managers to identify companies, mainly relatively smaller-sized companies, that they believe may offer the most promising returns.

As a second note, REIT property sectors can behave quite differently. With different drivers for each property sector, REITs can offer a combination of resiliency and economic momentum. Through stock, sector and regional selection, active managers can take advantage of the different phases of an economic and/or real estate cycle to potentially optimize returns.

Last but not least, on the surface, low-cost passive strategies can be appealing. However, we believe that investing with an experienced active managers offers several advantages and these advantages are reflected in historical performance. For instance, the Duff & Phelps Global REIT Strategy has outperformed the benchmark – and therefore passive strategies that trail this index – in 100% of the rolling 3-year periods since the strategy’s inception in 2009.

Q: In which sectors do you find the most attractive investment opportunities?5

A: In the current market environment, we think REITs stand to benefit from long term-term secular trends of higher home ownership, leading to higher rents, aging demographics adding to growth for senior healthcare, and the trend of A.I. boosting computing needs within the data center sector.

As such, we find great investment opportunities within the following market segments:

- Data Centers: demand for data center space is creating a multi-year secular growth story. Additionally, there are several constraints to building new supply delivery over the next 5-7 years. The team believes this space will continue to expand and views it as an opportunity to add value to portfolios, though current valuations must be considered to find strong opportunities.

- Senior Healthcare: this segment of health care is experiencing demographic tailwinds (i.e. aging population) and supply constraints, which the team thinks may add to outsized growth potential for the foreseeable future. Particularly in the U.S. healthcare property sector, senior housing operating properties and skilled nursing facilities will continue to see an improvement in occupancy. While current valuations appear higher than historical averages, the team believes select REITs in the sector can grow through current valuations and outperform.

- Residential: We have identified key areas of value across the residential sector. The elevated cost of home ownership, the lack of supply globally, and unique non-core subsectors are long-term growth tailwinds across residential. Within the non-core segment, which includes single-family rentals, manufactured homes, and student housing, we see the potential for excess growth in cash flow and earnings. For example, a lack of supply and strong barriers to entry in the U.K. student-housing market have helped our holding Unite Group PLC maintain consistently strong occupancy and steady rent growth. We have observed similar trends in Canada, which has experienced a large influx of migrants. For multi-family, supply is low while demand remains high, adding more flexibility for property owners.

Q: Are offices still as problematic as one may think?

In our view, the office property sector will likely remain one of the more challenging and controversial sectors on a global basis. Though hybrid work is a secular trend that has continued to put downward pressure on office, there has been a shift to more cyclical concerns related to slowing office job growth, lower job postings, and higher rates.

We remain very selective and cautious about offices. Our holdings within the sector are concentrated in companies with steady cash flow generation and strong balance sheets, with a high quality portfolio of properties that are mostly located in Central Business District areas – which have higher occupancy rates and pricing power.